The Warranty and Insurance Risks of Delaying a Hail Damage Roof Inspection

After a hailstorm, it is common for homeowners to step outside, look around and think, “It doesn’t look that bad.”

If there are no immediate leaks and no shingles scattered across the yard, scheduling a roof inspection may not feel urgent. But hail damage is often subtle, and delaying an inspection can complicate insurance claims and, in some cases, raise questions about whether resulting damage is related to the storm, prior wear or improper installation.

Insurance Claim Denial Due to Late Reporting

One of the primary risks of delaying a hail damage inspection is creating complications with your insurance carrier.

Most homeowner policies require “prompt notice” of storm damage. While that term may vary by carrier and policy language, extended delays can raise questions during the claim process. If too much time passes, it may become more difficult for an adjuster to connect the damage to a specific storm event.

Hail bruising and granule displacement often appear minor at first. Over time, sun exposure and normal weathering can change the appearance of shingles, making it harder to determine when the impact occurred.

The longer you wait, the easier it becomes for damage to be attributed to wear and tear rather than a covered storm event.

A timely professional inspection provides documentation that helps establish the condition of the roof closer to the date of loss.

Reduced Payouts for “Failure to Mitigate”

Insurance policies require homeowners to take reasonable steps to prevent further damage after a storm.

If hail has compromised shingles and you delay inspection or repairs, subsequent leaks or interior damage could be partially excluded. An insurer may argue that additional damage occurred because the issue was not addressed promptly.

For example, hail impact can displace protective granules and bruise the underlying shingle mat. That exposed area deteriorates faster under sun and rain. If months pass before inspection and widespread deterioration occurs, the insurance company may limit payout to the original hail marks rather than the expanded damage.

Acting quickly helps demonstrate that you took responsible steps to mitigate further loss.

Depreciation and Actual Cash Value Policies

Many homeowners carry policies that pay Actual Cash Value rather than full replacement cost. Under these policies, depreciation is subtracted from the payout.

Delaying an inspection can create complications. As shingles continue to weather under sun and rain, it may become more difficult to distinguish between storm-related damage and normal deterioration. That can affect how the claim is evaluated and what portion of the damage is covered.

In Replacement Cost policies, insurers often withhold depreciation until repairs are completed. These policies may require work to be finished within a specific timeframe to recover the withheld amount. Delays in inspection or repair can make that process more difficult and, in some cases, reduce total reimbursement.

Increased Repair Scope Over Time

Even minor impact marks can compromise the structural integrity of shingles. Over time, this can lead to:

- Granule loss

- Mat bruising (soft spots)

- Accelerated UV deterioration

- Seal strip compromise

- Wind lifting later on

What might have been a limited repair shortly after the storm can become a full roof replacement months later.

Interior damage from leaks can further expand the scope and cost.

Prompt inspections allow homeowners to understand the true extent of damage before it spreads.

Voiding or Limiting Manufacturer Warranty Coverage

Most roofing materials come with a manufacturer’s limited warranty. However, those warranties typically exclude coverage for damage caused by external forces such as hail.

If hail damage is left unaddressed, a manufacturer or contractor may decline warranty coverage for material defects or installation issues discovered later. They may determine that the roof system was compromised by storm impact rather than a product or workmanship failure.

A professional inspection helps differentiate between storm-related damage and potential material or installation issues, protecting your long-term coverage options.

Why Hail Damage Is Easy to Miss

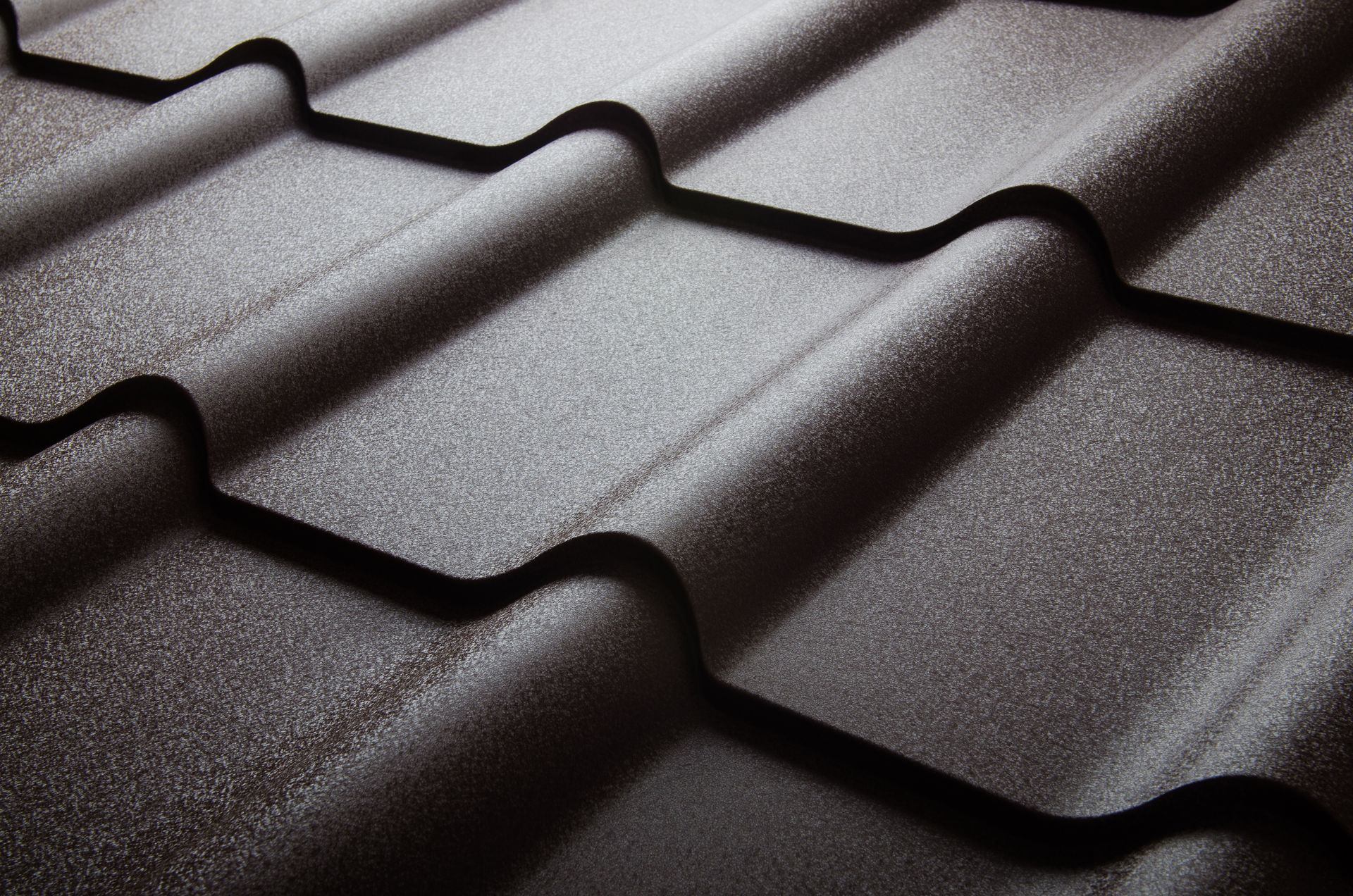

Unlike wind damage, hail does not always remove shingles. Instead, hail can bruise the underlying shingle mat, compressing the structure beneath the granule surface.

From the ground, everything may appear intact. Without a trained eye, impact points are often overlooked.

Unfortunately, those hidden weaknesses shorten the lifespan of your roof.

A professional hail damage roof inspection is the best way to verify whether unseen damage exists.

Fort Worth Hail Damage Roof Inspections With Clear Documentation

Billy Harris Roofing provides thorough post-hail inspections that document damage clearly and accurately. Our team helps homeowners understand what they are seeing, what it means for insurance and what next steps make the most sense.

Don’t wait to find out whether hidden damage is developing after a hailstorm. Contact Billy Harris Roofing today to schedule a professional hail damage inspection by calling (817) 249-3338 or (800) 320-6074.